Are you wondering what credit score is needed to secure a mortgage? Understanding the minimum credit score for mortgage approval is crucial for potential homeowners.

Having a good credit score can make all the difference in getting approved for a mortgage. It not only affects the interest rate you’ll qualify for but also determines whether you’ll be approved or denied.

A good starting point is knowing the mortgage credit score requirements. This knowledge will empower you to take the necessary steps to improve your credit score, if needed, and increase your chances of getting approved.

Key Takeaways

Table of Contents

- Understanding mortgage credit score requirements is vital for potential homeowners.

- A good credit score can significantly impact mortgage approval and interest rates.

- Knowing the minimum credit score for mortgage approval can help you prepare.

- Improving your credit score can increase your chances of getting approved.

- Being aware of the mortgage credit score requirements can help you make informed decisions.

Understanding Credit Scores and Their Impact on Mortgage Approval

Credit scores play a significant role in determining mortgage approval, making it essential to comprehend their calculation and importance. A credit score is a three-digit number that represents an individual’s creditworthiness, providing lenders with a snapshot of their credit history.

What Is a Credit Score and How Is It Calculated?

A credit score is calculated based on information in an individual’s credit reports, including payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. This calculation is typically done using a scoring model like FICO or VantageScore.

| Credit Score Component | Weightage | Description |

|---|---|---|

| Payment History | 35% | Record of on-time payments |

| Credit Utilization | 30% | Amount of credit used compared to the limit |

| Length of Credit History | 15% | Duration for which credit has been active |

| Credit Mix | 10% | Variety of credit types (credit cards, loans, etc.) |

| New Credit Inquiries | 10% | Recent applications for new credit |

Why Credit Scores Matter to Mortgage Lenders

Credit scores matter to mortgage lenders because they help assess the risk associated with lending to an individual. A higher credit score indicates a lower risk, making it more likely for the applicant to secure favorable mortgage terms.

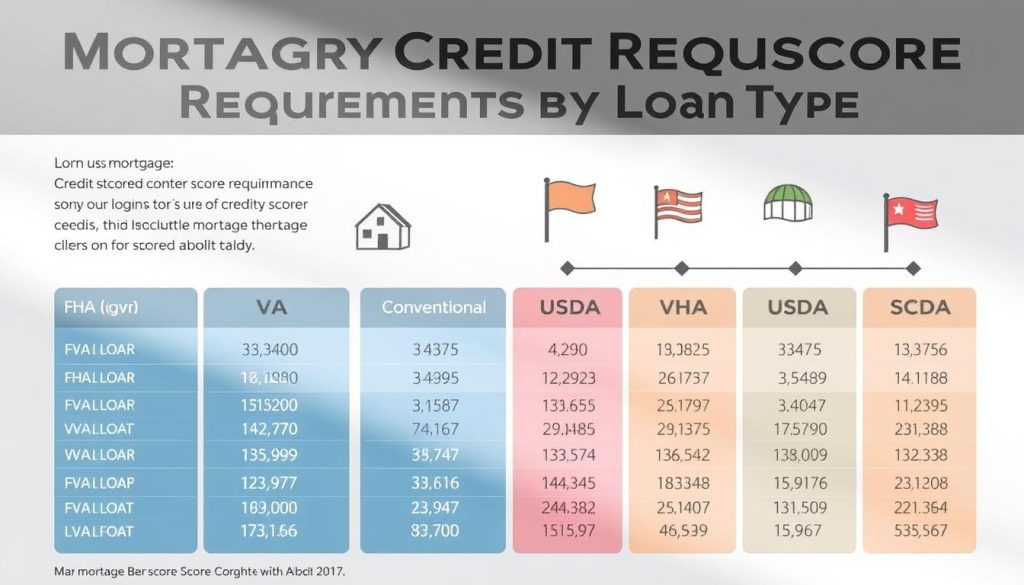

Mortgage Credit Score Requirements by Loan Type

Mortgage credit score requirements are not one-size-fits-all; they differ by loan type. Understanding these requirements is crucial for borrowers to determine their eligibility and choose the most suitable loan program.

Conventional Loans

Conventional loans, which are not insured or guaranteed by the government, typically require a higher credit score. Borrowers can expect to need a credit score of 620 or higher to qualify, though 700 or above is often required for the best interest rates. Some lenders may have stricter requirements, so it’s essential to shop around.

FHA Loans

FHA loans, backed by the Federal Housing Administration, are popular among first-time homebuyers due to their more lenient credit score requirements. Typically, a credit score of 580 or higher is needed to qualify for the minimum down payment. Borrowers with lower scores may still qualify but will need to make a larger down payment.

VA Loans

VA loans, guaranteed by the Department of Veterans Affairs, offer favorable terms for eligible veterans, active-duty personnel, and surviving spouses. While the VA doesn’t set a minimum credit score, lenders often require a score of 580 to 620. The flexible credit requirements make VA loans an attractive option for those who qualify.

USDA Loans

USDA loans, supported by the United States Department of Agriculture, are designed for borrowers purchasing homes in rural areas. There’s no minimum credit score requirement set by the USDA, but lenders typically look for a score of 640 or higher. These loans offer 100% financing, making them appealing to borrowers with limited funds for down payments.

In conclusion, the best credit score for a mortgage varies by loan type. Understanding the specific requirements for conventional, FHA, VA, and USDA loans can help borrowers navigate the mortgage application process more effectively and increase their chances of approval.

How Different Credit Score Ranges Affect Your Mortgage Terms

Understanding how your credit score influences your mortgage terms is crucial for making informed decisions. Your credit score is a key determinant in the mortgage lending process, affecting not only whether you’re approved but also the interest rate you’ll pay and the terms of your loan.

Excellent Credit (740+): Best Rates and Terms

Having an excellent credit score can open the door to the best mortgage rates and terms. Lenders view borrowers with high credit scores as less risky, offering them more favorable loan conditions. This can result in significant savings over the life of the loan. As Quoted by Forbes, “A good credit score can save you thousands of dollars in interest over the life of your loan.”

“A good credit score can save you thousands of dollars in interest over the life of your loan.”

Good Credit (700-739): Solid Options

Those with good credit scores are still in a strong position to secure competitive mortgage rates. While they might not qualify for the very best terms, they can expect solid options from lenders. This credit score range demonstrates a reliable payment history and responsible credit behavior.

Fair Credit (650-699): More Limited Choices

Individuals with fair credit scores may face more limited mortgage options. Lenders may offer less favorable terms or higher interest rates due to the perceived higher risk. However, it’s still possible to secure a mortgage, albeit with less ideal conditions.

Poor Credit (Below 650): Challenging But Possible

Qualifying for a mortgage with a low credit score can be challenging, but it’s not impossible. Borrowers may need to consider alternative loan programs or work on improving their credit score before applying. As noted by a financial expert, “Improving your credit score can significantly enhance your mortgage options.”

It’s essential to explore all available options and potentially seek professional advice when navigating mortgage applications with lower credit scores.

Beyond the Score: Other Factors That Influence Mortgage Approval

Lenders look beyond credit scores to assess mortgage applications, considering a range of important financial indicators. While a good credit score can improve your chances of approval, it’s not the only factor at play.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a critical factor in mortgage approval. It’s calculated by dividing your total monthly debt payments by your gross income. Lenders prefer a DTI ratio of 36% or less, though some programs allow up to 43%. A lower DTI ratio indicates a more manageable debt burden.

Employment History and Income Stability

Lenders also examine your employment history and income stability. A steady job and consistent income can significantly improve your mortgage prospects. Typically, lenders look for at least two years of employment in the same field.

Down Payment Amount

The amount you put down can also impact mortgage approval. A larger down payment reduces the lender’s risk and can lead to better loan terms. For conventional loans, a down payment of 20% or more can eliminate the need for private mortgage insurance (PMI).

Steps to Improve Your Credit Score Before Applying for a Mortgage

Improving your credit score is a proactive step that can make a significant difference in your mortgage application. A good credit score can help you qualify for better loan terms, including lower interest rates and lower fees. To enhance your credit score, follow these practical steps.

Check Your Credit Reports for Errors

The first step is to check your credit reports for any errors or inaccuracies. You can request a free credit report from the three major credit reporting agencies: Equifax, Experian, and TransUnion. Review your reports carefully and dispute any errors you find. This can help improve your credit score quickly.

Pay Down Existing Debt

Paying down existing debt is another effective way to improve your credit score. High levels of debt can negatively impact your credit utilization ratio, which is a significant factor in determining your credit score. Focus on paying down high-interest debt first, such as credit card balances.

Make All Payments on Time

Making all payments on time is crucial for maintaining a good credit score. Late payments can significantly lower your credit score, so set up payment reminders or automate your payments to ensure you never miss a payment.

Avoid Opening New Credit Accounts

Avoid opening new credit accounts before applying for a mortgage. New credit inquiries can temporarily lower your credit score, and having too many new accounts can indicate to lenders that you’re taking on too much debt.

Keep Old Accounts Open

Keeping old accounts open is another strategy to improve your credit score. Closing old accounts can negatively impact your credit utilization ratio and reduce the average age of your credit accounts, both of which can lower your credit score.

By following these steps, you can improve your credit score and increase your chances of getting approved for a mortgage with favorable terms. Remember, improving your credit score takes time and discipline, but the benefits are well worth the effort.

- Check your credit reports regularly

- Pay down high-interest debt

- Make timely payments

- Avoid new credit inquiries

- Keep old accounts open

Improving your credit score is a journey, and with the right strategies, you can achieve a better financial future.

Strategies for Getting Approved with a Lower Credit Score

Securing a mortgage with a lower credit score can be challenging, but there are several strategies that can improve your chances of approval. When qualifying for a mortgage with a low credit score, it’s essential to explore all available options.

Finding the Right Loan Program

Different loan programs have varying mortgage loan credit score requirements. For instance, FHA loans are more lenient with credit scores compared to conventional loans. Researching and identifying the most suitable loan program can significantly enhance your approval chances.

Increasing Your Down Payment

Making a larger down payment can offset the risk associated with a lower credit score. By putting down more money, you demonstrate financial stability and a commitment to your mortgage, making your application more attractive to lenders.

Working with a Mortgage Broker

A mortgage broker can be invaluable in navigating the complexities of the mortgage application process. They have access to multiple lenders and can help you find a loan that accommodates your credit situation.

Considering a Co-Signer

If your credit score is a significant barrier, having a co-signer with a stronger credit profile can bolster your application. This shared responsibility can provide lenders with the assurance they need to approve your mortgage.

By implementing these strategies, you can improve your chances of getting approved for a mortgage despite having a lower credit score. It’s about finding the right combination of factors that work in your favor.

Conclusion: Taking Action on Your Mortgage Journey

Understanding mortgage credit score requirements is crucial to getting approved for a mortgage. By knowing the best credit score for mortgage approval, you can take steps to improve your creditworthiness and secure better loan terms.

Mortgage credit score guidelines vary by loan type, and being aware of these differences can help you choose the right loan program for your situation. Whether you’re aiming for a conventional loan or exploring government-backed options like FHA or VA loans, your credit score plays a significant role in determining your mortgage eligibility.

Now that you’re equipped with the knowledge of mortgage credit score requirements, it’s time to take action. Focus on improving your credit score, and consider working with a mortgage broker to find the best loan options for your needs. By taking these steps, you’ll be well on your way to achieving your dream of homeownership.